- brian.finance

- Posts

- Jim Cramer's 10 Failed Dot Com Bubble Stocks & Why They Failed. Part One: The Data Center Flop of Exodus Communications

Jim Cramer's 10 Failed Dot Com Bubble Stocks & Why They Failed. Part One: The Data Center Flop of Exodus Communications

What Cramer’s Failed Dot-Com Picks Teach Us About the Risks in Today’s AI Infrastructure Boom

On February 29, 2000, at the height of the dot-com bubble, Jim Cramer gave a now infamous keynote speech on "The Winners of the New World" at TheStreet.com’s 4th Annual Internet Conference held in New York City.

In this speech, Cramer presented ten stocks, referring to them as the "infrastructure" or "arms merchants" of the new economy. He argued that they were the only stocks worth owning because they were building the framework of the internet.

"We are buying some of every one of these this morning as I give this speech. We buy them every day, particularly if they are down, which, no surprise given what they do, is very rare. And we will keep doing so until this period is over — and it is very far from ending…

We try to own every one of them. Every single one. And if I had my druthers, I wouldn't own any other stocks in the year 2000. Because these are the only ones worth owning right now in this extremely difficult, extremely narrow stock market… I love every one of them, just as I loathe the rest of the stock universe."

So why these specific ten? Cramer described these stocks as the companies that made the web "faster, cheaper, better." He picked them because they would be the “plumbing” of the connected internet era.

So did these businesses succeed? Let’s take a look at Jim Cramer’s 10 Winners of the New World stock picks:

Stock | Fate | ROI |

|---|---|---|

Exodus | Bankrupt | -100% |

Inktomi | Acquired (Yahoo) | -99% |

InfoSpace | Collapsed | -99% |

Digital Island | Acquired | -94% |

724 Solutions | Acquired | -98% |

Ariba | Acquired (SAP) | -65% |

Veritas | Merged | -84% |

Mercury | Acquired (HP) | -42% |

Sonera | Merged | -93% |

VeriSign | Survivor | +10% |

Portfolio Returns on Cramer’s Picks:

If you had invested $100,000 equally into these 10 stocks ($10,000 each) on the day of the speech:

9 of your 10 positions would have lost money, with 6 of them resulting in a loss of 90% or more.

Your $10,000 in VeriSign would be worth $11,000 today.

Your total $100,000 investment would be worth roughly $23,600 today.

If you had invested that $100K in the S&P 500 index instead on the same day, your portfolio would be worth over $720,000 today, nearly 30x higher than these "critical infrastructure" picks.

So why did Cramer get everything so wrong? In this article series, I’ll be taking a look stock by stock to see the bull case and why it failed. By learning from these mistakes, we can potentially avoid making the same ones as Cramer during the AI boom.

Stock One: Exodus Communications

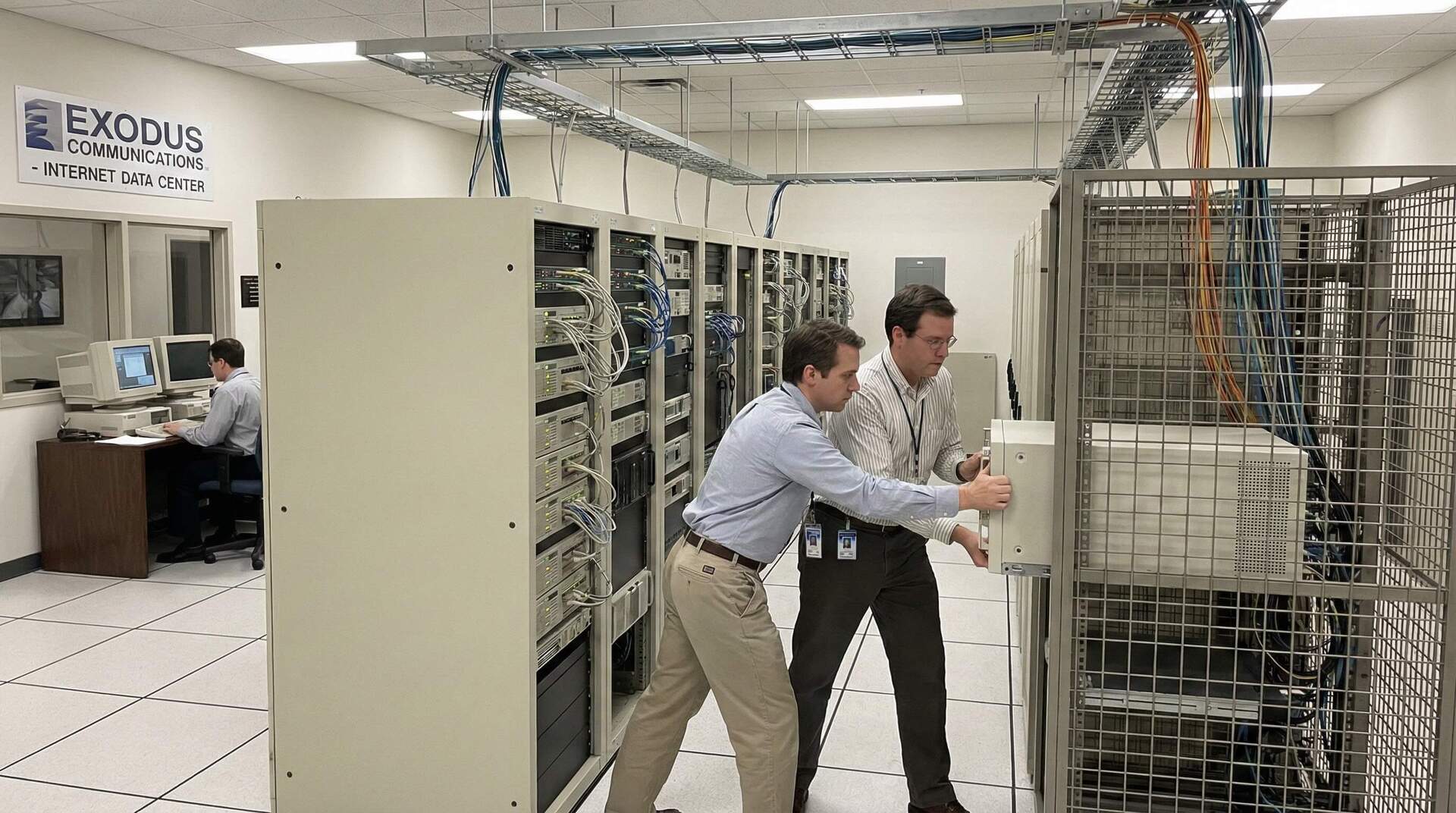

Exodus Communications was a data center business. Back in the 90s, when things started moving online, the data center business was nascent. Many websites were amateurly hosted at corporate headquarters. A janitor pulling out a plug might disconnect the hosting server (oops).

These makeshift in-house corporate data centers were often poorly connected, resulting in congestion and failure. Reliability was low, security was absent, and there was absolutely no scalability.

This created an opening for a data center business to offer professional services to corporate America. Instead of having your in-house IT do something disastrous, you can hire Exodus Communications as an enterprise grade data center facility.

Exodus managed the environment, the network, and the security, allowing client companies to focus on their software and business models. The Exodus business model operated through co-location.

Here’s how co-location data centers worked (remember this is pre-cloud computing in 2000).

You would purchase rows of server racks and have them shipped to an Exodus IDC (e.g., in Santa Clara, CA or Jersey City, NJ).

The Installation: Your IT engineers would physically drive to the Exodus building, get badged in by security, walk to their assigned cage, and rack the servers themselves.

The Connection: Exodus would drop a fiber optic or ethernet connection into the cage. Clients plugged their servers into the Exodus network, which sat directly on the high-speed backbone of the internet.

Maintenance: If a hard drive failed at 3:00 AM, the client’s IT guy had to drive to the Exodus data center to swap it out. (Later, Exodus offered managed services where they would do this for you for an extra fee, known as Smart Hands).

So why do this as a client? Remember, this is before cloud hosting. At this time the only other options were to host it in your office closet at headquarters (where power outages or other issues could knock you offline), or to spend millions on your own professional on-prem data center.

Sounds like a great upgrade right?

Every corporation in the US that wanted a better solution than building it themselves could use Exodus for their data center needs. And as the internet grew, one would assume Exodus would as well.

And Exodus did grow in the year 1999. They reached annual revenue of $242 million, 359% higher than the year prior. The average client spent $196,000 a year on them. This was real revenue. Just take a look at their growth trajectory below:

Year | Annual Revenue | YoY Growth | Net Loss | Context |

1996 | $3.1 Million | - | N/A | Early transition to IDC model |

1997 | $12.4 Million | 300% | $(26.7) Million | Gaining traction with early adopters |

1998 | $52.7 Million | 325% | $(69.3) Million | IPO year; rapid expansion begins |

1999 | $242.1 Million | 359% | $(130.3) Million | The height of the dot-com boom |

2000 | $818.4 Million | 238% | $(256.0) Million | Peak mania; massive CapEx spending |

With those numbers, the market gave them a peak market cap of $32B. The net loss was there, but that was because of capex spending on growth. Investors viewed them as the corporate data center that powered American digital infrastructure. This business was the gold standard of its market. It was a no-brainer bet on the internet transition.

The investment bull-case: Exodus Communications

The logic of investing in Exodus in 2000 was something like the following:

It’s impossible to predict which websites will be the winners in 2000. Would eToys beat a ToysRUs website? Who can say. But what we do know is that the internet will grow in use. (Doubling in use every 100 days in fact). Therefore, owning the physical capacity to host websites is a more risk-free way to win from internet upside. As long as the internet grows, you win.

And businesses had to either host things themself, or use Exodus (or a much smaller lesser known competitor). Building your own data center at the time took 12-18 months and costs upwards of $10 million. For any dot com startup, that was too much. These businesses want to start running and be capital light, so going with Exodus was the easiest way to save money and be fast.

Exodus was also known for their technical superiority. They were run by a former Apple and IBM executive. The business was a darling of IT, Wall Street, and clients.

While they did have competition, Exodus was considered the market leader at the time. Digex was their next nearest competitor, generating around $60 million a year (vs Exodus at $242 million) in 1999, and AboveNet at $14 million. Verio was the largest non-enterprise competitor, focused more on SMBs, with $100M in revenue.

Because demand was so high, the way to beat competition was to acquire customers first. That meant building faster. It was a land grab.

And if you’re curious, almost all of the competitors at the time no longer exist today or are much smaller than they were before. It wasn’t just Exodus that went down, it was virtually everyone.

So what happened? Why didn’t Exodus succeed?

Exodus Communications - The Downfall

From the point of our bull case, it took less than 18 months for Exodus to declare chapter 11 bankruptcy and become a literal zero for investors. How did this happen? Let’s examine.

First, Exodus was a capital heavy business. They built data centers. These cost a lot of money. They did everything high quality. This also costs a lot of money.

In order to build these data centers, they used debt. Their debt ratio in the year 2000 was 45%.

From Exodus’s point of view, this labor intensive cost was a barrier to entry for new competitors. In the year 2000, Exodus’s primary concern was approving new construction projects and completing acquisitions to fend off competition and grab land before anyone else. Once you locked in customers, it was unlikely they would churn do to switching costs.

Before the dot com bubble burst, Exodus also made one large move that we should note.

In September 2000, the company announced the acquisition of GlobalCenter, the web hosting unit of Global Crossing, for $6.5 billion in stock. GlobalCenter laid fiberoptic cable. This was vertical integration. Exodus hosted the data centers, and Global was the cable that connected things. The combined entity would operate 44 data centers worldwide and serve over 4,000 customers.

GlobalCenter was also full of debt, which it used to funnel growth.

The stage is now set for Exodus’s eventual bust (debt is only part of the story, not the primary catalyst).

The Unraveling Begins: The Dot-Com Contagion (Q4 2000 – Q1 2001)

As 2000 went into 2001 the bubble went from a correction to a full blown stock market crash.

This meant VC’s checkbooks were closed. Nobody was getting more debt. You had to work with what you had.

So what does that mean?

It means all of the new dot com startups that were hosting their websites and services on Exodus no longer had access to capital. Without the free VC money flowing in, things were about to get hard.

In Q4 2000 and Q1 2001 Exodus’s churn rate began to increase. It wasn’t a big increase. The churn rate at this time rose gradually, just to 3% from 2%.

Management initially downplayed the nominal increase, arguing that growth in enterprise customers (Fortune 500 companies) would offset the losses from more fragile startups churning.

There was also another problem at this stage. Exodus often accepted equity (stock warrants) in its startup customers as part of their service contracts, or invested directly in them. This supported the ecoystem and helped them get upside on the businesses they were supporting. But when these businesses started to lose market cap, so did the asset value of these investments.

One investment they held in Snippet had a $400M impairment charge as a result during these quarters.

This created a double jeopardy scenario for Exodus. When a customer failed, not only did they lose revenue, they also could lost balance sheet assets (or revenue from previous quarters that was essentially covered by equity instead of cash payments).

In Q1’2001, Exodus suffered from an earnings miss. The stock fell 21% in a single day. Churn was still increasing from fragile dot com startups no longer getting funding from venture capital.

The Summer in Crisis (Q2 2001 – August 2001)

Exodus was now on warning from Wall Street after missing guidance the previous quarter.

Then, on May 2, 2001, shortly after the Q1 results miss, Exodus issued a profit warning that fundamentally altered its relationship with Wall Street. The company revised its revenue guidance down for the year, citing "softening demand" and a "lengthening sales cycle".

Obviously with all the dot com websites no longer getting capital investments, growth couldn’t continue short term as normal, even if internet demand was rising at the same time.

The profit warning resulted in downgrades across the board, from Goldman Sachs to Merrill Lynch.

By the end of Q2 2001, the financial situation was clear. Revenue dropped 9% sequentially and the net loss remained high.

Exodus was burning over $500M a quarter as a capital intensive business. They still had to pay for leases on long-term data center floorspace, regardless of the utilization rate. When initially signing leases, they planned for high capacity use, which didn’t materialize. And they only had $616 million in cash on hand.

On a cash flow basis, they were burning around $150 million per quarter. That only gave the business around 12 months to be solvent or reach breakeven.

Total debt stood at approximately $3.5 billion, with $4.4 billion in assets. Most of the debt was in the form of high-yield bonds and convertible notes. With the stock trading low, the conversion feature of the notes were worthless, meaning the debt remained a hard liability that had to be serviced with cash the company didn't have.

The Collapse: Fall 2001

In September, with investor confidence gone, the CEO resigned and the board decided to bring in someone new. The new CEO attempted to project calm, stating that the company would focus on "tough-minded fiscal discipline".

Soon after, Standard & Poor’s and Moody’s aggressively downgraded Exodus’s debt ratings deeper into "junk" status, due to the risk of the business going under.

As a result, operating the business became untenable. Vendors started requiring cash on delivery for anything sold. No net 30, no net 60 terms.

The downgrade also triggered default covenants on some lease and financing agreements.

Finally, enterprise customers feared the servers would go dark and began looking for other solutions, such as data centers that didn’t have debt and cash flow risk. As well as moving things on-prem.

This marked the end for Exodus Communications.

On Wednesday, September 26, 2001, Exodus Communications filed a voluntary petition for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the District of Delaware.

At the time they had $3.5 billion in assets, $4.4B in liabilities, and the market cap was around $100 million. The business was auctioned off in bankruptcy court. Investors received absolutely nothing.

Lessons & Learning From Exodus Communications

So what can we learn from Exodus Communications?

For one, the overarching bull case in theory was correct. The internet was growing and data centers would be needed.

But… the business model had issues.

Exodus was on a capex treadmill that accelerated as it grew. To maintain its growth rate, it had to keep rapidly expanding capex and infrastructure. And all that new infrastructure didn’t make the business cost less on a per unit basis.

Once a data center was completed, the 2nd data center buildout didn’t improve cost of goods sold economics. In fact, economics were worse until the 2nd data center was at full utilization.

The first data center’s gross margins remain the same, no matter how many data centers you build.

On the funding model, the business grew through debt. And they took on long-term leases on data center properties. Whether a data center was 100% full or 10% full, the rent and electricity for cooling had to be paid. When demand softened, these fixed costs crushed margins immediately.

Moral of the story: Capex heavy growth needs economies of scale. If profitability isn’t clear, the business may be growing simply on debt and it is not going to become a profitable business in the near term (or long term).

If the liquidity tightens, businesses that derive revenue from startups will struggle. One should watch for businesses that depend on start-up heavy companies where liquidity may crunch from a change in market sentiment.

My takeaway from Exodus is it may be wise to avoid companies that are capex heavy without a clear and obvious path to profitability, especially if they are funded by debt. One cannot assume profitability will simply come. Revenue and growth are “easy” if you are making things cheaper for the consumer. There must be a strong case for bottom line economics to be a success as a capex heavy business scales.

The #1 lesson: Watch for boom/bust liquidity cycles. Although the internet continued growing aggressively, data center growth was accelerated beyond that from VCs funding new businesses. When venture capital and debt pulls back, that can pull back overall spend, even if a product has growing adoption.

Be alert of businesses without robust balance sheets that are funded by debt, and ones where customers also funded by debt or venture capital. Although the industry may continue to grow, it doesn’t mean business capital allocation will grow smoothly alongside it.

Exodus Communications’ failure serves as a warning for debt heavy AI infrastructure businesses of today. They share the characteristics of debt fueled land grab businesses, where economies of scale are questionable.

Just because AI is growing quickly does not necessarily mean the businesses will grow in-line with capex spend, and a rugpull could heavily punish margins.

That’s it for today’s article. Subscribe to get more insights from the dot com bubble with analysis on Cramer’s second pick, Inktomi, which fell 99% in share price within 2 years.

If you enjoyed this article, you may also be interested in reading How Information Overload Leads Investors Astray.

Our content is provided subject to our Disclaimer.

Reply