- brian.finance

- Posts

- Lemonade Insurance Q2'2025 Earnings Preview

Lemonade Insurance Q2'2025 Earnings Preview

What I'm watching and expecting for $LMND's second quarter results

It’s that time of year. Earnings season is right around the corner and Lemonade has officially announced Q2’2025 earnings call for August 5 at 8:00 AM ET.

In this article I’ll be giving an earnings preview for Lemonade Inc. For earnings season, I do things a little bit differently than most.

As a long term investor my focus is not on trying to one up Wall Street by predicting short term performance minutiae. My focus as a long term investor is the long term performance of each business I own.

This means, my goal is to confirm the fundamental business story is on track. I focus on the metrics my bull case is centered around, while keeping an eye out for areas of potential concern.

Alright, let’s get started.

My Lemonade Bull Thesis

Lemonade operates in a legacy insurance industry of old players with lots of tech debt and organizational debt. They are not well incentivized to move quickly. Lemonade has created a modern single interconnected digital tech stack that creates the least bottlenecked and cleanest system to fully leverage AI & automation, as proven through beating legacy businesses in their pet & renters product (a low margin, high claim frequency product).

My bull thesis is that Lemonade is currently winning Pet & Renters, and that, given enough time and focus, they will also win Car insurance, which is a massive market. If successful, over time, this could create a company worth over $150 billion (or more). Lemonade is currently valued at only $3 billion, representing potential 50x or higher upside.

Lemonade Q2’2025: My Top 3 Things To Watch:

Car Quarter over Quarter Gross Loss Ratio & Growth

Overall Gross Loss Ratio & Gross Loss Ratio ex-catastrophe events

Marketing Efficiency (In Force Premium gain vs marketing spend)

There is nuance in evaluating each of these items. Insurance often has cyclicality, which means some quarters tend to have higher loss ratios than others. There is also a new business penalty where loss ratios tend to be higher for new policies, so if a particular policy line is scaled significantly, one can also expect some level of increase in the gross loss ratio vs the standard baseline.

1. Lemonade Car Stats to Watch

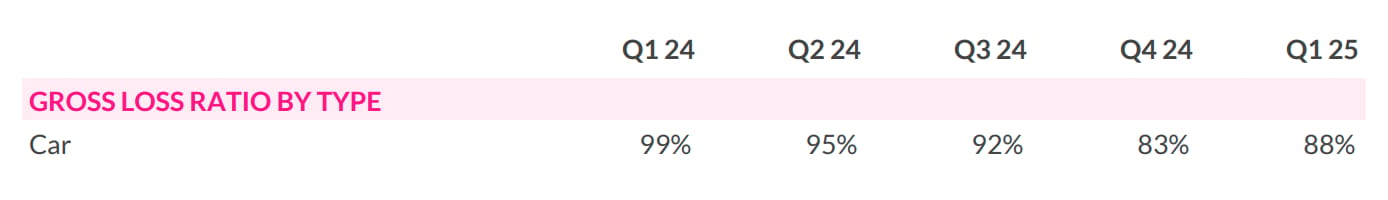

Car GLR was 88% last quarter as shown below. My expectation is to see this number stay flat, or rise by no more than a few percentage points. I’m looking for numbers below 90% here.

If Lemonade aggressively grows Car and this number falls below 88%, I view this as bullish.

Additionally, Car IFP grew QoQ by $12 million in IFP in Q1. About $8.4 million was from new policies (the rest being from rate hikes). Policy growth in Q1’2025 was 4,537 for car.

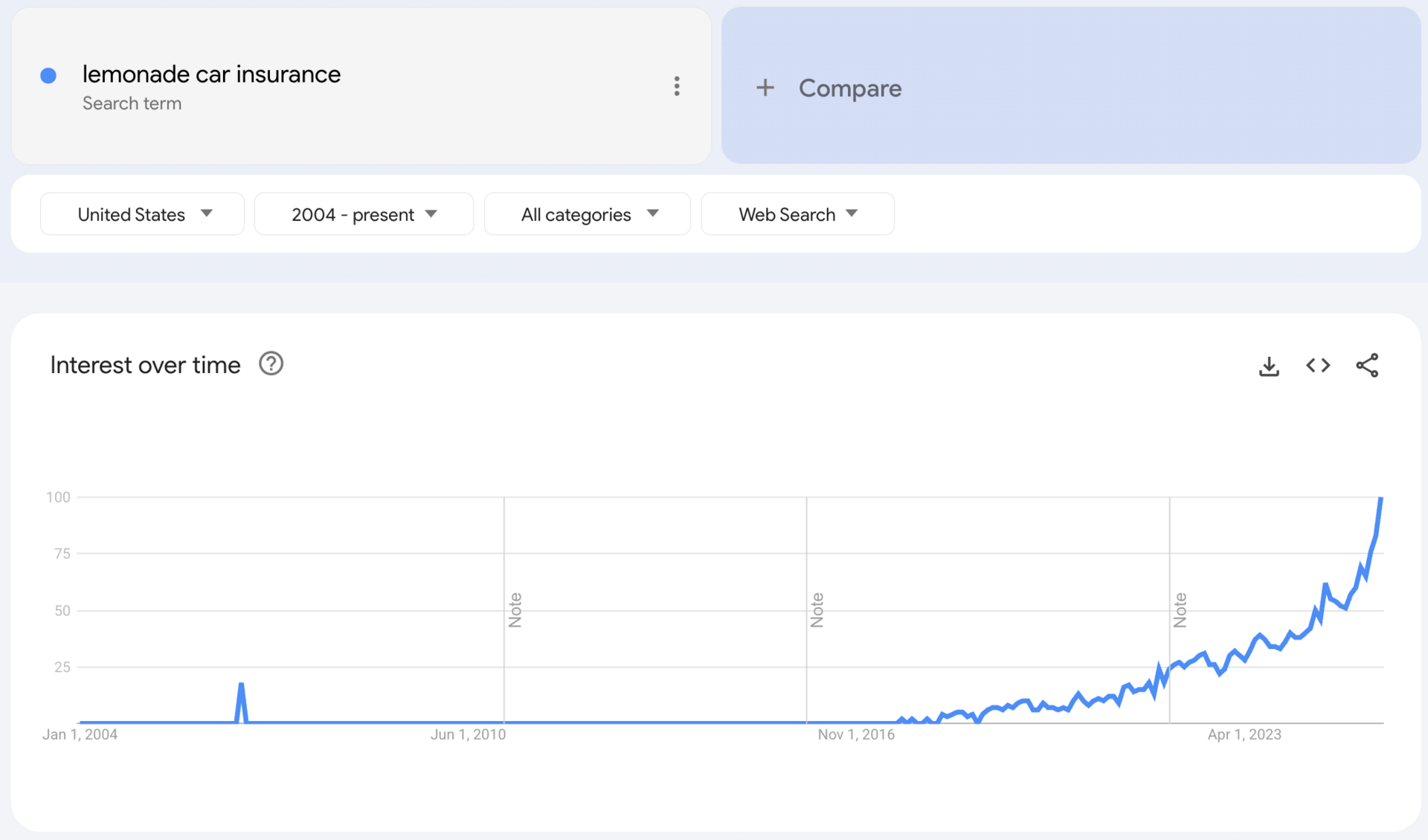

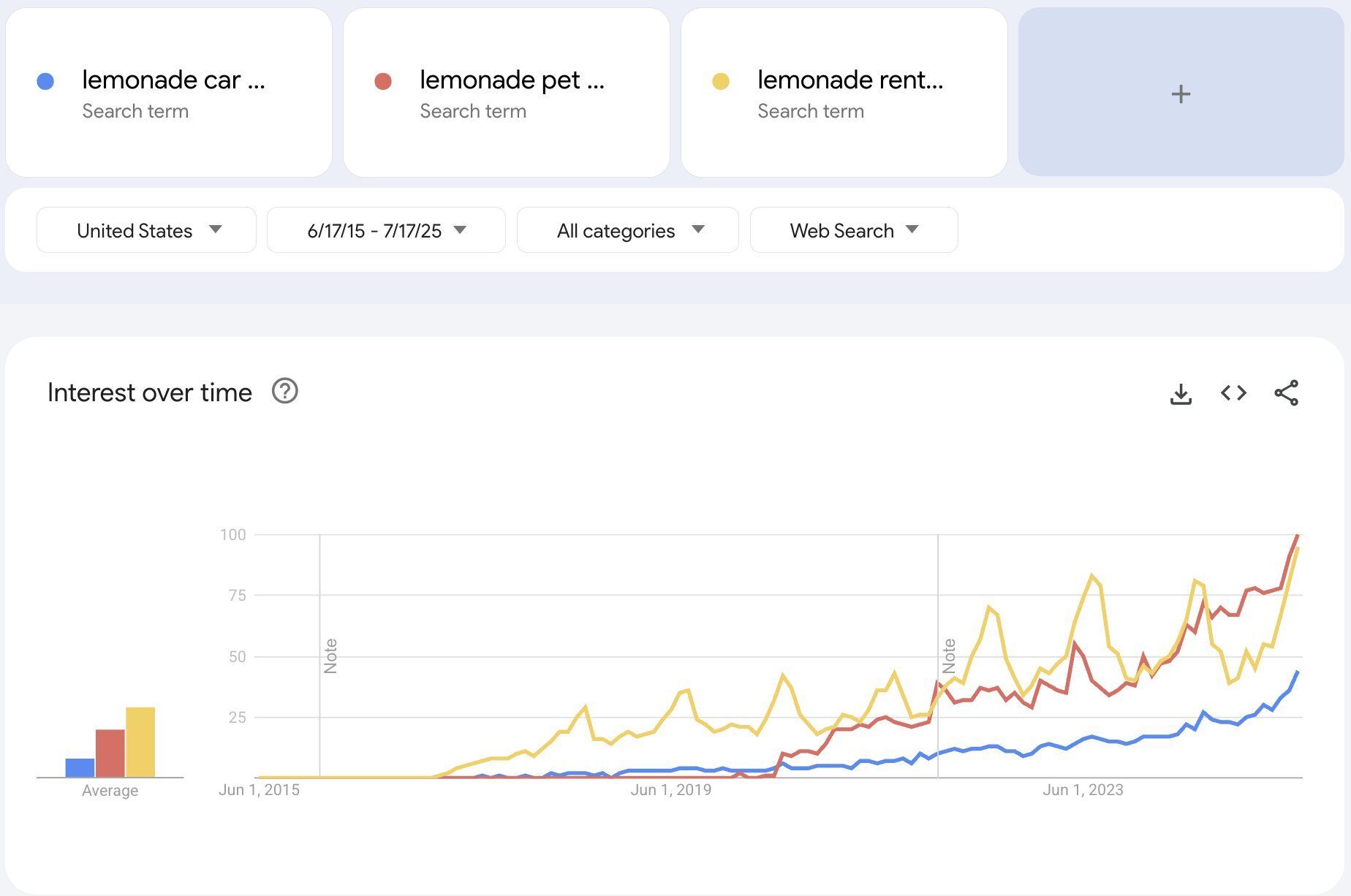

I’d like to see this number accelerate, which I expect based on Google Trends showing more interest in the product and Lemonade opening up car insurance to Colorado in March 2025.

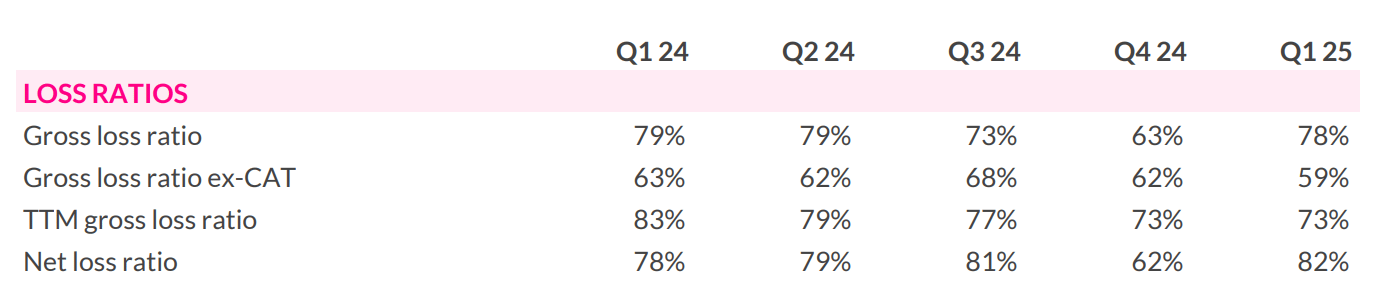

2. Lemonade Overall GLR TTM & GLR ex-CAT

It’s important to note that loss ratios, even excluding CAT, are seasonal. In Q2’2024 we saw GLR ex-Cat at 62% and last quarter we saw GLR ex-CAT at 59%.

I want to see this number be relatively stable. 59% to 63% is a good range. If we see this number bump up beyond 64% or so, it would require further investigation from me. For instance, is this a result of new business penalty in Car? Or is it because of inflation or other factors that could make the business less profitable in the near term?

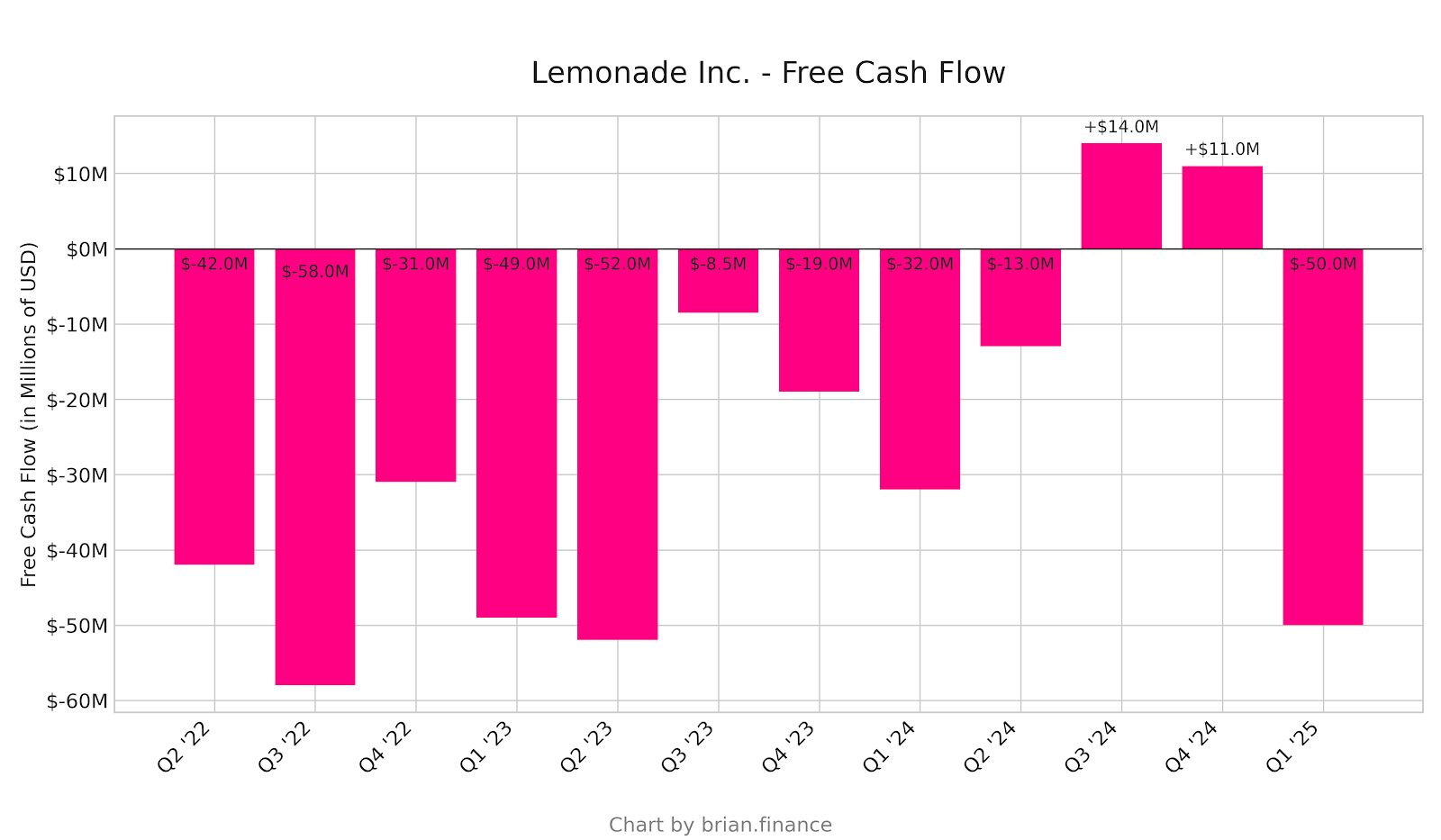

Gross loss ratio & net loss ratio are ultimately a major factor each quarter in what Lemonade’s FCF number will be. That is because, almost all other metrics are stable (other than variability in ad spend). Therefore, if there are not many CAT events in a quarter, then the net loss ratio will be low, and result in cash flow generation for Lemonade.

This is why in Q4’24, Lemonade saw one of their strongest cash flow generating quarters, with Gross loss ratio including cat of only 63%.

Because CAT events are seasonal, highly impactful, but also random, I prefer to look at GLR on a Trailing Twelve Month basis rather than weigh a single quarter too highly. Ultimately, the GLR is an important metric, so we can’t simply ignore CATs.

For GLR TTM, 73% TTM is where we currently are, and I’d like to see us stay at that level or continue to decline.

The current GLR TTM doesn’t need to decline significantly at this point, as Lemonade is already generating good gross profitability, and scale at this point should help cover fixed costs. We don’t necessarily need to see significant declines in GLR TTM as long as scaling continues and the current levels of customer retention remain steady.

3. Lemonade Marketing Efficiency

Finally, the last major metric I’m looking at is marketing efficiency. As Lemonade scales, they need to keep ramping up marketing spend to meet their ambitious growth targets (noting that Lemonade said in their second investor day that 1/3rd of new customers are organic).

If Lemonade’s gain in new customers/premiums for the amount of marketing spend starts to decline, that could be a sign that they are brushing up on market saturation. We therefore want to monitor this vigilantly. Meanwhile, if premium gain actually improves vs marketing spend, it indicates upselling customers to different products, such as car, is proving effective.

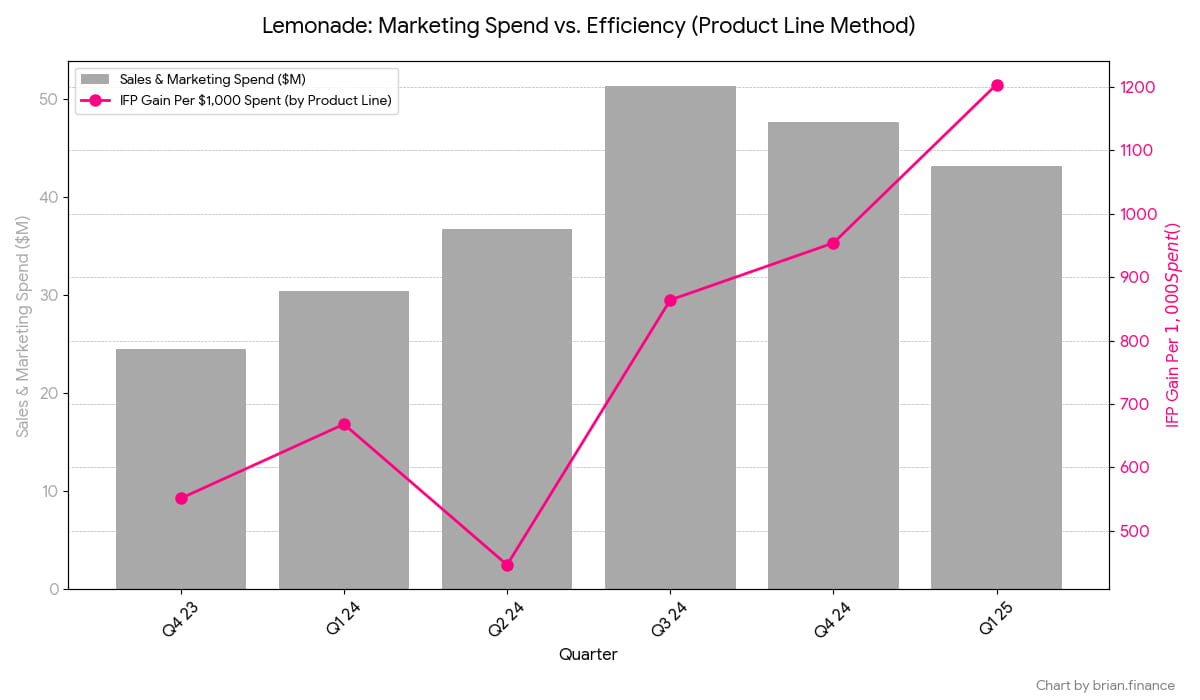

Below is a chart I made showing the amount of estimated $IFP gain per $1,000 spent on Sales & Marketing. The way I calculated this looks specifically at policy growth, so as to exclude gains simply from rate hikes.

Note: The "IFP Gain Per $1,000 Spent" was calculated by determining the change in policy count for each individual product line from the previous quarter and multiplying it by the current quarter's Premium per Customer for that line. The results for all product lines were then summed for the quarterly total. This method isolates growth specifically from new policy acquisition across the business. It provides a guiding estimate and is not exact.

Marketing is cyclical, so IFP gain from ad spend is going to be different from quarter to quarter. Generally speaking, one would expect the most expensive ad costs to be in Q4, which means you simply spend less in those quarters and get lower returns than other quarters, for instance.

New policy signups are high intent in Q2 and Q3, when people make major purchases and relocate more often, which often make them the ideal quarters for maximum ad spend. While Q1 rates are cheaper, there is generally less intent to purchase policies, such as renters insurance, as people are less likely to move then.

As we see in the chart, marketing spend has really ramped up in efficiency recently, which is very bullish. It’s unclear if last year’s Q2 was an abnormality or expected cyclicality.

With all that being said, I’m looking to see IFP Gain Per $1,000 Spent to be $750 or higher. If we maintain above $1,000 gain per $1,000 spend, I would see this as very bullish. If it falls to Q2’2024 levels of under $500 IFP gain per $1,000 spent on marketing, it would be a mild yellow flag that we could chalk up to cyclicality, with the expectation of Q3 outperforming back to $1,000 gain or more, like we saw in 2024.

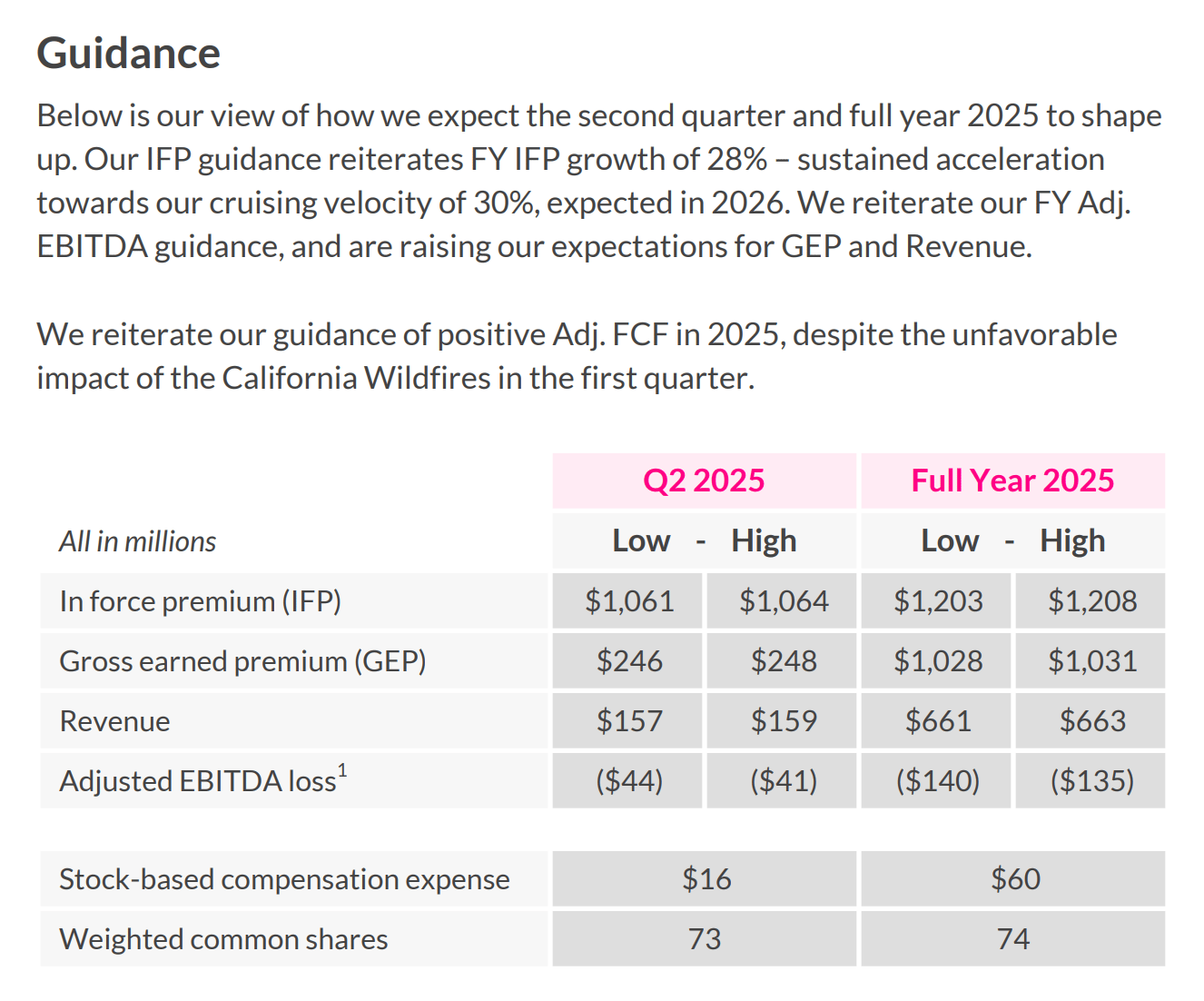

Lemonade Q2’2025 Guidance & Expectations

Official guidance for Q2 is as follows from Lemonade’s Q1 earnings report.

On the revenue side, there is potential for a revenue beat, given that Google Search interest has dramatically risen for Lemonade's main product lines.

Ultimately, Lemonade largely chooses its growth rate through ad spend. It is possible it will increase ad spend or that ad spend will prove more impactful in a quarter than expected.

On the Gross Loss Ratio side, Progressive recently published a new 8K for the second quarter of 2025 showing their combined ratio improved by 5.7 points year-over-year, declining to 86.2 from 91.9 in Q2 2024. We also see that PGR reported:

Year-to-Date (as of June 30, 2025): The net catastrophe loss ratio was 2.9%.

Year-to-Date (as of June 30, 2024): The net catastrophe loss ratio was 4.8%.

Thus, showing an improvement in CAT vs prior year. This is potentially a good sign of a lighter CAT season for Lemonade vs Q2’2024; however, PGR and Lemonade do operate in different geographies with different risk pools, so actual results may vary significantly.

Lemonade Q2’2025: Final Thoughts

Overall, I’m going into this quarter very bullish. I don’t see any obvious red flags, although I am cautiously optimistic about the recently announced change to their reinsurance %, which allows them to maintain a higher percent of their premiums, while also being responsible for a higher % of potential losses.

Google Trends indicates that the business is very strong with record search interest as previously reviewed.

I hope to see free cash flow trending in the right direction again, a leading indicator of profitability, which was somewhat derailed by the Q1’2025 LA Fires as we see below.

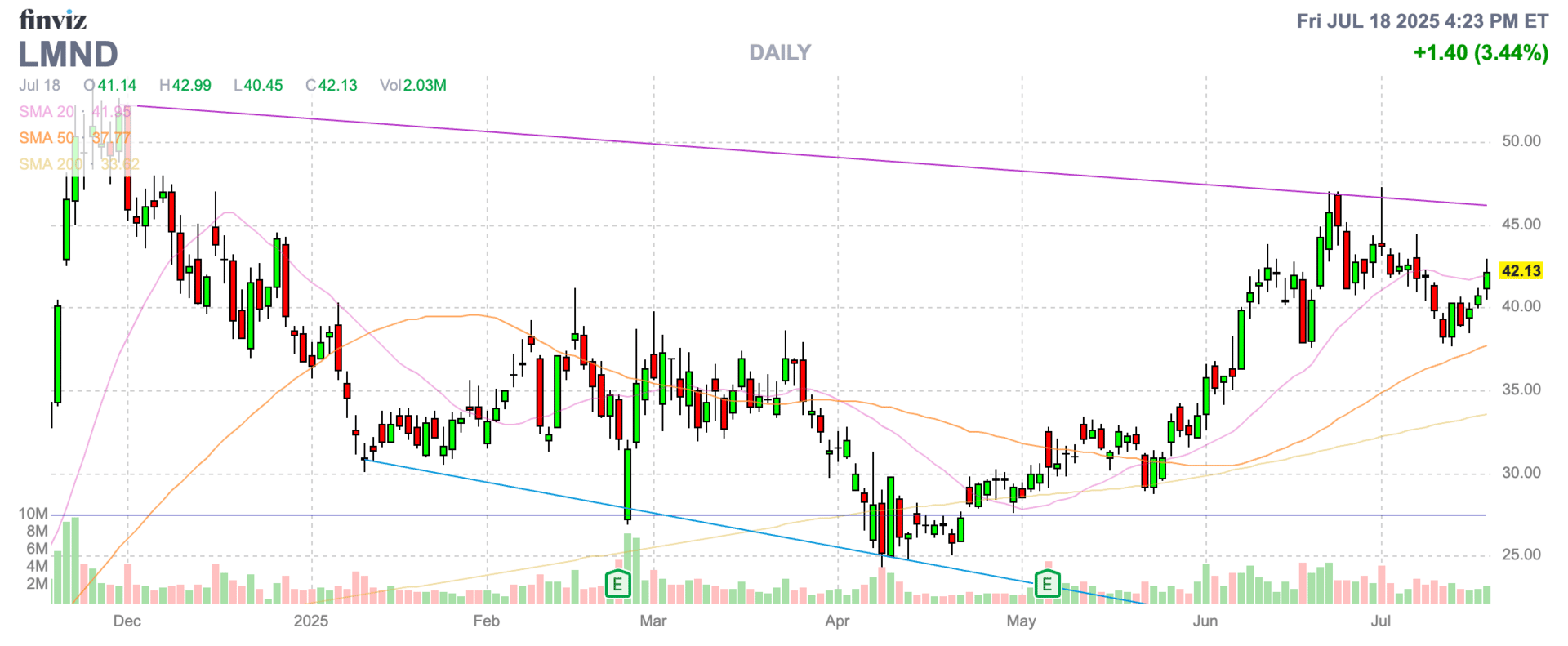

Lemonade Technicals & Price Action

On a technical level, we see Lemonade is currently trading right on the SMA 20, and is above both the SMA 50, and SMA 200 on the daily chart. The 200 day simple moving average is currently at $33.64 and rising.

Volume has been relatively stable over the past year, with a notable increase during November 2024 when it ran up significantly, and during the April tariff dip. June volume was slightly elevated and tapered somewhat back to average in recent weeks.

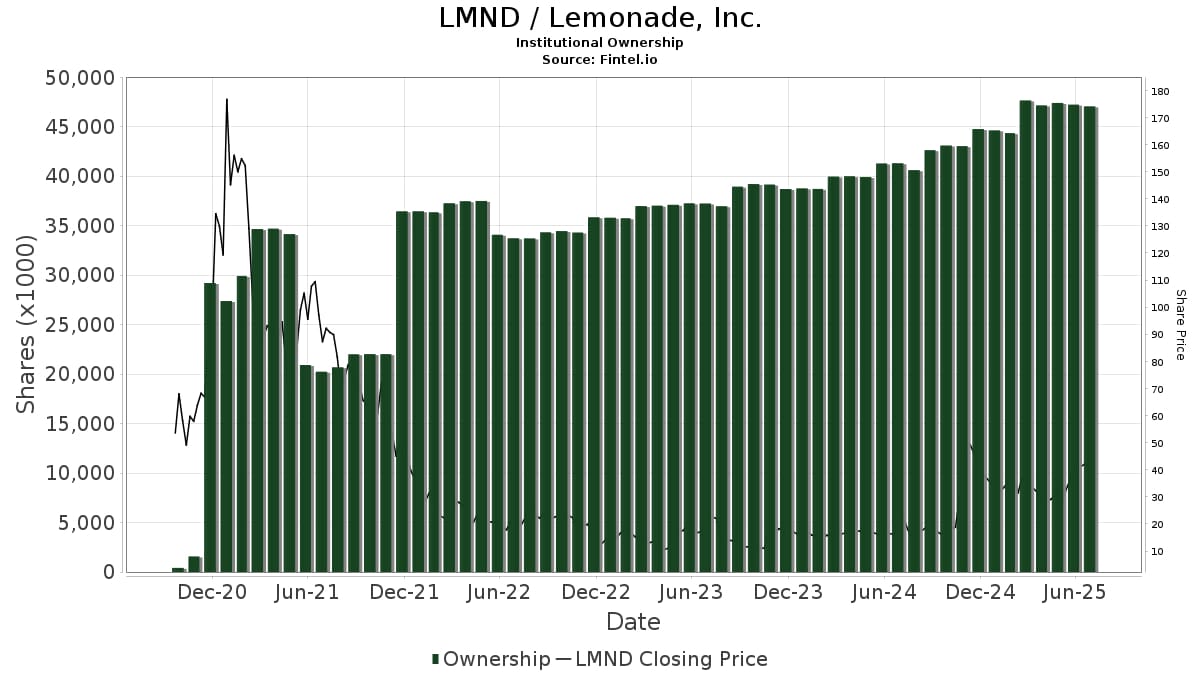

Lemonade Institutional Ownership Update

Institutional ownership continues moving up and to the right; however, it is down slightly over the past month

Lemonade Short Interest Update

Lemonade short interest is currently at 27.76%, with 5.21 days to cover according to Fintel.

That’s everything for this earnings preview!

The Q2’2025 Lemonade earnings call is available for registration here, and the previous Q1’2025 Lemonade Shareholder’s Letter is available here.

If you have questions or comments, drop them in the comment section below.

Disclosure: I am currently long Lemonade. My stock portfolio and allocation % is available on SavvyTrader for free for premium blog subscribers.

Not financial advice. Our content is provided subject to our Disclaimer.

Reply