- brian.finance

- Posts

- 3 Reasons the Stock Market Underestimates Root Insurance, and Why It Might Be Wrong

3 Reasons the Stock Market Underestimates Root Insurance, and Why It Might Be Wrong

Why Wall Street may be misjudging this quiet insurtech

Root Insurance took a 30% hit to its share price this August. The market doesn’t seem to be too optimistic, giving it a market cap of around $1.4B, nearly half of what it was worth at its peak in March. Though, they are still up an impressive 80% y/y.

The narrative from Wall Street is that total policy growth slowed in Q2 due to a competitive soft insurance market, which drove underwhelming marketing performance.

Not only is Wall Street writing off Root, so are many investors looking for innovative AI & digital tech companies to buy. But is its growth story being written off too harshly by both Wall Street and Retail?

Let’s take a look at three reasons why investors are underestimating Root, and why they might be wrong.

Reason #1 - The Management Team

First, let’s start with the management team.

The two main members to focus on here are Alex Timm, the founder and CEO, and Matt Bonakdarpour, who was recently promoted to President and is also the CTO.

When reviewing the management team, we don’t get Jeff Bezos or Elon Musk vibes. For starters, those founders actively took interviews and were in the public eye to explain their grand vision to the world.

We also don’t get the eccentric sage type vibes. Alex Karp presents a persona that is quirky, unusual, and hard to get a read on. The kind of personality that makes you say, this person is different and has some secret sauce. Mark Leonard of Constellation Software is also a mystery, but comes off as a reclusive sage.

Alex Timm, on the other hand, has none of these characteristics.

At first glance, he gives off the persona of an average midwesterner. He dresses rather ordinarily, has a boyish look, and speaks straightforwardly with a friendly, youthful, and relatable tone.

He went to college in Iowa, a state known best for farming and the simple life, and not much else. His father was a prominent insurance executive for a company headquartered in Ohio, which is also the same state where Root has its headquarters today. It is not a place where big tech companies typically place their headquarters.

If you need assistance fixing your flat tire, Alex Timm appears to be the kind of guy who will lend you a hand. But is he the guy to found the next nationwide car insurance company?

This is in stark contrast to the high flying publicly ambitious startups of Silicon Valley and NYC founders with bold visions.

That’s not to say Root doesn’t have bold visions. Because it does. Alex frequently reminds investors that their goal is to become the #1 insurance carrier in the United States. The bold vision is there.

But the tone and way he presents himself are relatable, authentic and down to earth. This is something likely tied to his upbringing and values from Ohio to Iowa. It’s a philosophy that is shared in Root’s brand guide here.

And while on the surface that might seem like a disadvantage for what Root is trying to accomplish, it might not be so bad. Root has a heavy focus on the partnership channel. That includes becoming the embedded and point of sale insurer of choice for brands from Carvana to independent agents.

While that Iowan and Ohioan attitude might leave Wall Street unimpressed, it’s the perfect tone for signing up insurance partners. They want someone they can trust.

Independent agents can trust Alex Timm’s family pedigree in the insurance space. Alex is actually an actuary by training. His tone and demeanor give him excellent camaraderie and shared values with independent agents, as well as the kind of trust partners can believe in. No broken tech promises, a straight shooter.

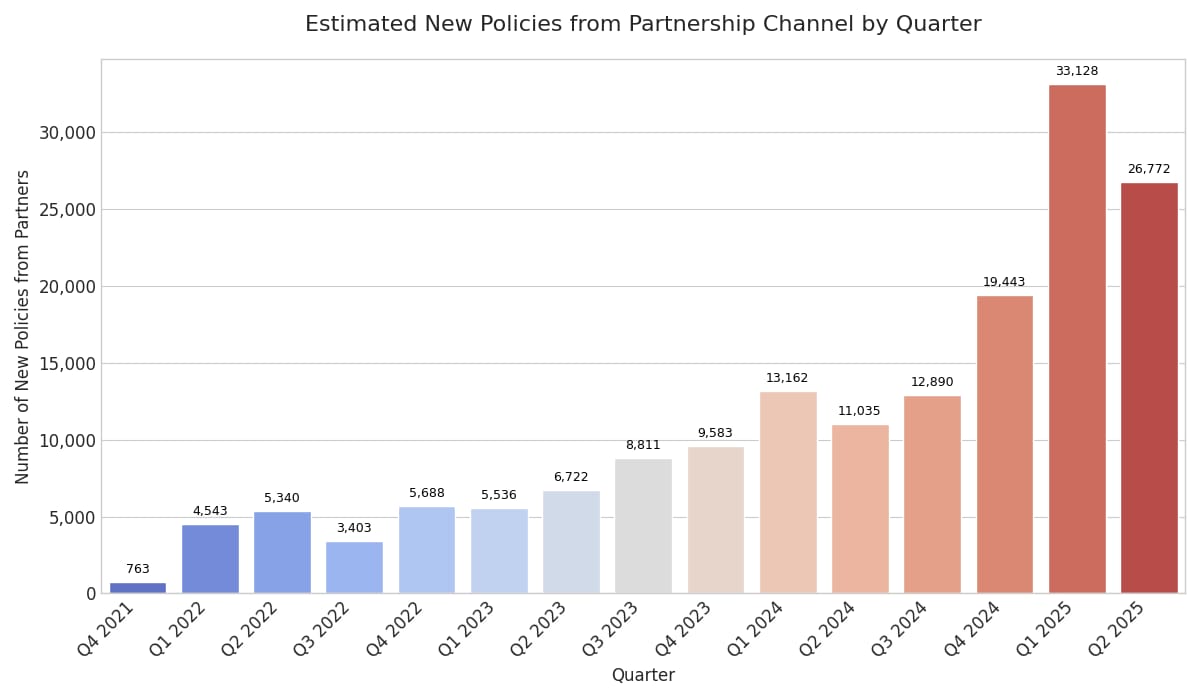

It’s no wonder that Root has nearly tripled growth in sales from their partnership channel over the past year.

Timm got his degree in Actuarial Science, Accounting, and Mathematics. He was also a senior consultant at Nationwide before founding Root. Combine this all together with his family pedigree, and it makes sense why Root has some of the most impressive loss ratios in the insurance industry, right there with the likes of Progressive, the $100B behemoth widely heralded as the most innovative and successful car insurance company in the US today. Root is doing all of this at a significantly smaller scale.

So, perhaps there is more to this Timm guy? His personal brand may not be appealing for Wall Street, but it’s right for the people that matter to the business.

The other person to watch is Matt Bonakdarpour, now President at Root. His background is particularly impressive. He got his BS at Carnegie Mellon University in Computer Science & Mathematics. He then went to The University of Chicago for a PhD in statistics.

After graduating school, he became a quantitative researcher at Citadel, and a visiting scholar at Yale, all before becoming CTO at Root, and now President.

All together, Root has an incredible level of quantitative insights in management. It’s no coincidence they are driving an impressive combined ratio of 95 while still being a very small (but growing) player on the national stage. Once more fixed costs are spread across a larger number of policies, one has to wonder how far ahead of large legacy insurers they could become.

As for skin in the game of the management team, some investing websites show incorrect information, as they report Class A shares only, and don’t report Class B.

Both leaders are well incentivized with significant skin in the game.

As founder, Alex Timm is loaded with shares that he hasn’t sold. Per the April 07, 2025 filing below, he has over 1,100,000 shares. That’s around 10% of the entire 11.25M float. We also see Matt has a healthy 3.4% of the total float. That’s strong for a non-founding leader.

Reason #2 - Growth Is Slowing, High Churn, and Carvana Is the Only Big Partner?

Subscribe to our premium content to read the rest.

Join a select group of investors who get my personal portfolio updates, deep-dive stock analysis, and exclusive access to the financial toolkit I use to navigate the market.

Already a paying subscriber? Sign In.

Reply